Even if they don’t realise it, most businesses derive benefit from the natural world and are exposed to risk where these are degraded. Where investment decisions don’t factor in natural capital impacts and risk exposure, the result can be disastrous, both for business and for people.

The now-bankrupt Pacific Gas and Electric stands as one stark example – facing billions of dollars of claims after their infrastructure sparked the devastating Camp forest wildfire in California in 2018. Another is any number of financial investments in agricultural production that ignore the need for soil conservation, despite the 2018 UN estimate that we have only 60 harvests left before our soil is too degraded to feed the planet.

Although these dependencies are increasingly understood, the algorithms that govern the flow of investment finance still typically fail to factor in natural capital impacts and risks. But things are set to change.

Natural Capital and Ecosystem Services

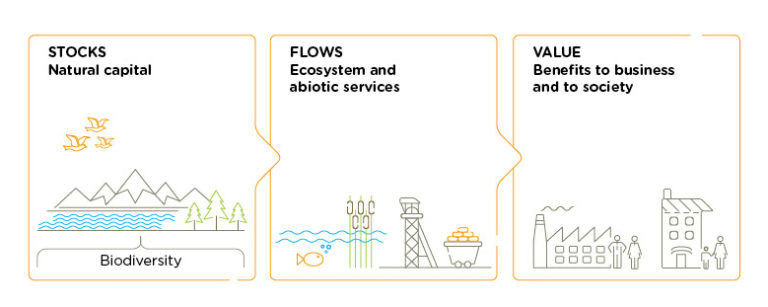

Mirroring the concept of Capital stocks delivering a flow of financial returns, the term Natural Capital denotes a stock of natural assets (including forests, soil, air, rivers, species and ecosystems) that deliver a flow of benefits to the economy and society in the form of various Ecosystem Services (such as pollination of crops, flood prevention or recreation). By recognising our dependence on these services, governments and corporations understand the need to value and conserve natural capital as an asset class. At the same time, valuing the economic contribution of ecosystem services allows development in markets for these, which were previously seen as ‘free goods’.

Source: Natural Capital Coalition

An example from within the UK is the Woodland and Peatland carbon codes, which provide a framework for the emergence of a market in ISO certified carbon credits from sustainable land management. Forward looking organisations such as Natural Capital Partners and Forest Carbon are actively developing schemes and brokering commercially viable deals between land managers and investors, that channel investment finance into good environmental stewardship.

How to scale up the supply of Natural Capital Finance is a hot topic. I was lucky enough to attend the Ecosystem Knowledge Network’s Natural Capital Investment Conference earlier in 2019, where participants discussed the current trends, opportunities and remaining challenges to create market mechanisms that channel wholesale investment finance out of the capital markets and into protecting nature. High upfront costs, inconsistent returns, high risks, small scale, lack of proof of concept, complexity: these are just some of the barriers to creating commercially attractive investment products. And even for impact investors, securing commercial rates of return remains crucial.

Natural Capital Finance

A wide range of financial products and funding models is being developed to channel investments into natural capital and ecosystem services. Blended finance models involve use of public funds to cover the riskier upfront innovation costs, and so make an investment more attractive for risk-averse private investors. In the UK, the government-backed Green Investment Bank has been crucial in catalysing investment into offshore wind as an asset class, with private sector capital now flowing easily. The potential of ‘stacking’ ecosystem services is also attracting interest- such as combined health and environmental protection services – to generate multiple income streams.

Internationally, a range of model investment products or green bonds have emerged that fund green infrastructure, including the first publicly traded Environmental Impact Bond (EIB) to invest in natural solutions to address flood risk in Atlanta. Other examples include the Seychelles Sovereign Blue Bond, and the Forest Resilience Bond, developed by the World Resources Institute (WRI), which uses a debt and equity model to fund forest restoration to deliver watershed protection and fire suppression benefits.

Public funds are also being used to deliver against national and international policy agendas: in the UK, DEFRA’s Environmental Land Management System (ELMS) is intended to be the world’s biggest Payment for Ecosystem Services (PES scheme), investing public money for public goods. The ambition is to incorporate private finance into delivering outcomes as new approaches are tested and proved – though it’ll be a few years yet before the results-based payments scheme is up and running. Despite the challenges, the wave is gathering pace.

Food and agriculture are big impact investment opportunities – there has been a lot of private equity and venture capital activity around supply chain management, ‘farm to fork’ traceability, drone technology, indoor production, artificial protein etc. But most UK farmland is in private or family ownership in relatively small units (about 40% in UK are tenanted farms; average farm size is around 200 acres). Translating impact investment and delivery of benefits to a bigger scale in this context requires innovative models and solutions. Farmers need better information on natural capital investment opportunities so they can make their own decisions, while investors need opportunities that are large enough to deliver investment returns. Platforms such as Entrade that bring together asset owners and investors will be key to breaking down silos and streamlining transactions.

Historically, the reinsurance sector has been earlier in understanding the financial sense of investing in the ecosystem to hedge risks and can offer lessons to investors on natural disaster risk (an example is risk mitigation provided by environmental features that are known to protect against flood damage, like coral reefs, mangroves, and riverine forests). The Global Ecosystems Resilience Facility (GERF) was launched at the 2018 World Ocean Summit by Willis Towers Watson as the first global insurance facility focusing on risk transfer and project finance to improve the resilience of coastal and island communities to climate pressures. The Natural Capital Finance Alliance (NCFA)’s ENCORE tool has been launched in 2019 to enable investors to identify their impact on and exposure to such natural capital risks, while the Natural Capital Coalition (NCC) has set up the Natural Capital Protocol as a standardised framework to support business decision-making and help organizations to understand the value of their dependence on ecosystem flows – currently being trialled for land-based businesses. The principle of Biodiversity Net Gain is increasingly being adopted in planning regimes and is intended to become mandatory in the UK as part of the forthcoming Environment Bill; pension funds are embedding climate risk and sustainability into their portfolios, and in 2017, credit rating agency Moody’s warned that they would downgrade US cities if they didn’t plan for climate risks.

Source: Natural Capital Coalition

The Geospatial Solutions Opportunity: Monitoring, Reporting and Verification

A big challenge for natural capital investment products is how to make verification beneficial for landowners and cost effective for investors. On-site visits are time consuming and costly, while modelling can result in asset owners or farmers having results-based payments withheld because of mistakes in their data and reporting. Doing a comprehensive baseline audit is a big challenge for landowners but is likely to be required to participate in ELMS, and regular monitoring, measurement and verification of impact will be a continued requirement. DEFRA are trialling a range of techniques including use of geospatial data.

Opportunities for catalysing investment in the rural environment in the UK include the Woodland Carbon Code, the Peatland Code, Biodiversity Offsetting via the UK government’s proposals to make Biodiversity Net Gain agenda mandatory for developments requiring planning permission, Water Catchment initiatives, and Product and Supply Chain certification. All of these rely on Outcome-based payments that require monitoring and evaluation to verify that they have delivered the intended environmental benefit and will need cost-effective and reliable ways to do this.

A key barrier for the development of natural capital financial products is that there are many different standards frameworks with little or no alignment between them: there is not a single set of metrics that meets the needs of all. Some are process based while others use metrics aligned to various frameworks including the SDGs, or the Peatland and Woodland Carbon codes. The Natural Capital Protocol Toolkit is a useful starting point that provides information on a range of available measurement tools and frameworks. For businesses the Global Reporting Initiative (GRI) is the main framework, while the Global Impact Investor Network (GIIN) has developed its impact measurement and management tool, IRIS, which includes metrics for measurement of investment impact against its own standards and against the SDGs. New standards under development include an ISO standard for environmental economic impact, and many others.

For Green Bonds and other sustainable financial products, there will be a need for initial impact assessment and monitoring and reporting throughout the life of the investment. This impact reporting needs to be comprehensive and transparent, and, metrics need to include contextual information with mapping of risks and opportunities included in the regular reports. Biodiversity metrics present practical challenges – they require both quantitative and qualitative reporting, but frequently rely on proxies, and too often the verification exercise can be desk-based with no site visits. Although monitoring and verification is becoming easier with increased use of satellite data, there are still challenges to be overcome.

A key facilitator of mainstreaming natural capital risk into portfolio reporting will be impact measurement approaches to demonstrate profitable, environmentally sound and measurable results. Many investments are still driven by information in Bloomberg terminals, which are blind to natural capital risk. Tools like NCFA’s ENCORE have been developed specifically to close this gap by getting better data into the terminals, and better investment decisions as a result. Methodologies for linking natural capital data with financial data are still evolving, but the direction of travel is clear.