The UK Government’s Green Finance Strategy and the Opportunity for Geospatial Solutions

Marketing

Aligning private sector financial flows with clean, environmentally sustainable and resilient growth and strengthening the competitiveness of the UK financial sector.

These are the ambitious objectives of the UK government’s Green Finance Strategy published on the 2nd of July 2019.

Climate change, the depletion of our natural resources, and the rapid decline of biodiversity are the major global issues of our time. On the global stage, the UK is taking the lead and raising ambitions to tackle these issues. We are the first major economy to commit to net zero greenhouse gas emissions by 2050 and our 25 Year Environment Plan will ensure we are ‘leaving the environment in a better condition than we found it’. Delivering on these ambitions means a systemic change across economic sectors which will require huge investments and a new financial system that supports these outcomes. The Green Finance Strategy is the UK’s first step towards delivering this vision. This article summarizes some of the Strategy’s key takeaways and highlights those areas where geospatial solutions will be needed for an efficient and cost-effective transition.

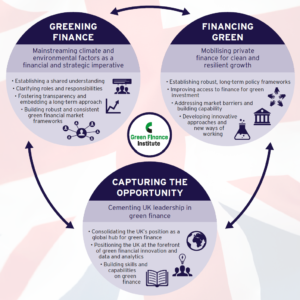

Green Finance Strategy three strategic pillars (Source: HM Government – Green Finance Strategy)

The transition to a more sustainable and resilient world is reshaping the global economy as countries, industries, and institutions seek to mitigate and adapt to the effects of climate change and environmental degradation. This is creating a whole range of climate and environment related risks and opportunities across every single industry that investors need to understand and act upon. Greening finance means mainstreaming climate and environmental factors within financial decision-making, both within the UK, driven by financial regulation and regulators, as internationally, alongside other governments and international development partners. Geospatial data and solutions have an important role to play around:

Achieving clean, resilient and environmentally sustainable societies and economies will require investment at an unprecedented scale. The International Energy Agency estimated USD 13.5 trillion of investment will be needed in the energy sector alone between 2015 and 2030 to reach Paris agreement targets. To support the flow of capital to the necessary green technologies and projects, the UK will work on establishing long term policy frameworks, addressing market barriers, building capability and improving access to finance for clean technologies and projects. Up to date information will be needed to track progress, creating the need for geospatial solutions to support:

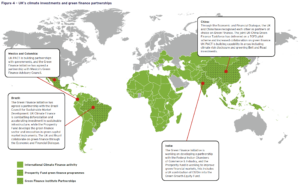

UK’s climate investments and green finance partnerships (Source: HM Government – Green Finance Strategy)

Demand for green finance will grow substantially over the years to come, creating a global market for low carbon financial services estimated at £280 billion/year by 2030 and £460 billion/year by 2050. The UK has strengths across the full financial services spectrum and is uniquely placed to capitalise on this opportunity. The government will work alongside the Green Finance Institute to consolidate the UK’s position as a global hub for green finance, position the UK at the forefront of green financial innovation, data and analytics and build capabilities and skills on green finance.

One of the biggest areas of opportunity are around green finance innovation, both in terms of green financial products and services and the underlying data and analytics. Asset managers are increasingly scrutinizing environmental, social and governance (ESG) performance of their investments, the London Stock Exchange Group is offering a platform for green and ESG linked products, banks are launching green mortgages and even consumers are aligning their investments with their (ESG) values through dedicated crowdfunding and retail investment platforms. Reliable and accessible climate and environmental related data and analytics are needed to mainstream these initiatives across the entire financial system globally.

The UK government already provides a wealth of publicly available environmental and climate-related data and is committed to enhancing the quality, coverage, and use of geospatial data across all sectors of the economy, including the financial sector. They highlight the need for further innovation and coordination in data availability, comparability and aggregation, as well as a better understanding of existing datasets and potential applications within the financial sector. Some ongoing work and initiatives in this area include:

The Green Finance Strategy sets out the actions to accelerate the growth of green finance in the coming years to cement UK leadership in the field and capitalise on the commercial opportunities linked to clean growth and green finance. It outlines high ambitions and short timeframes that will require strong and collective action to deliver.

The UK space and geospatial sectors have an important role to play in providing an evidence base for effective financial decision making and efficient capital allocations. Our industry has a wealth of data available and the know-how to process and interpret it. It is time we combine these insights with other non-financial and financial datasets to create timely insights at scale that are relevant for financial stakeholders to make the right decisions. Bringing together both sectors, with their different players, cultures and languages will be a challenge but one that is worth taking given the urgency of the global issues we are facing and the scale of the commercial opportunity that lies ahead. If there was ever a time to do it, the time is now and the UK is the perfect place to start.