Understanding and Monitoring Natural Capital and the Opportunity for Geospatial Solutions

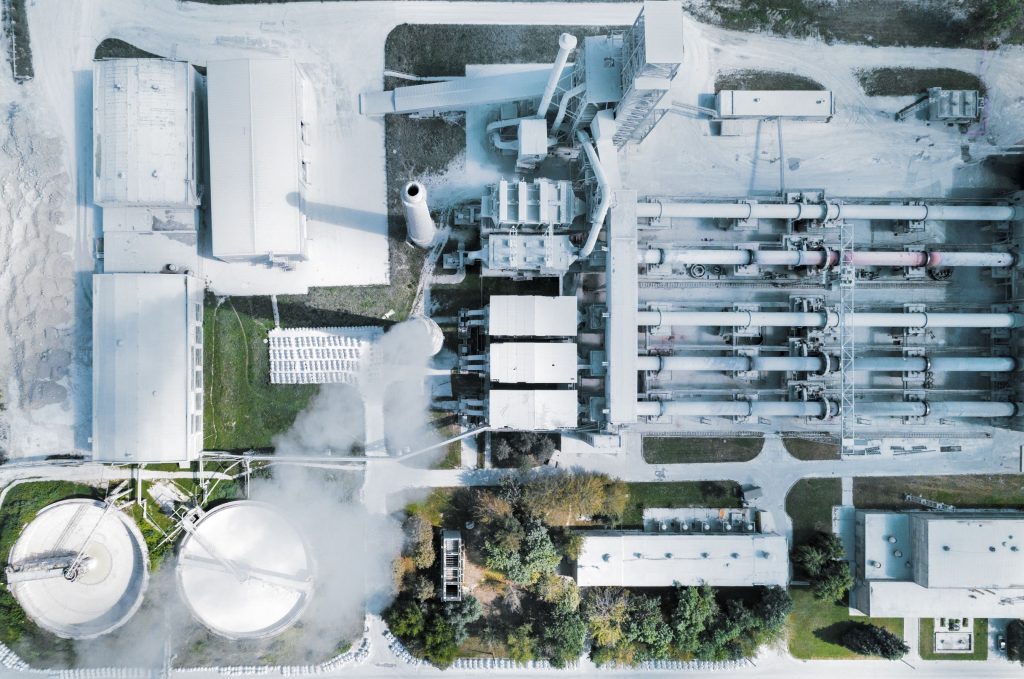

Even if they don’t realise it, most businesses derive benefit from the natural world and are exposed to risk where these are degraded. Where investment...

The transition to a sustainable global economy will be the most capital-intensive transition in human history. ‘Sustainable finance’ or ‘Green finance’ is about aligning the financial system with global sustainability. This includes

Sustainable finance brings together different areas of UK has expertise, such as financial services, data analytics and low carbon technology innovations.

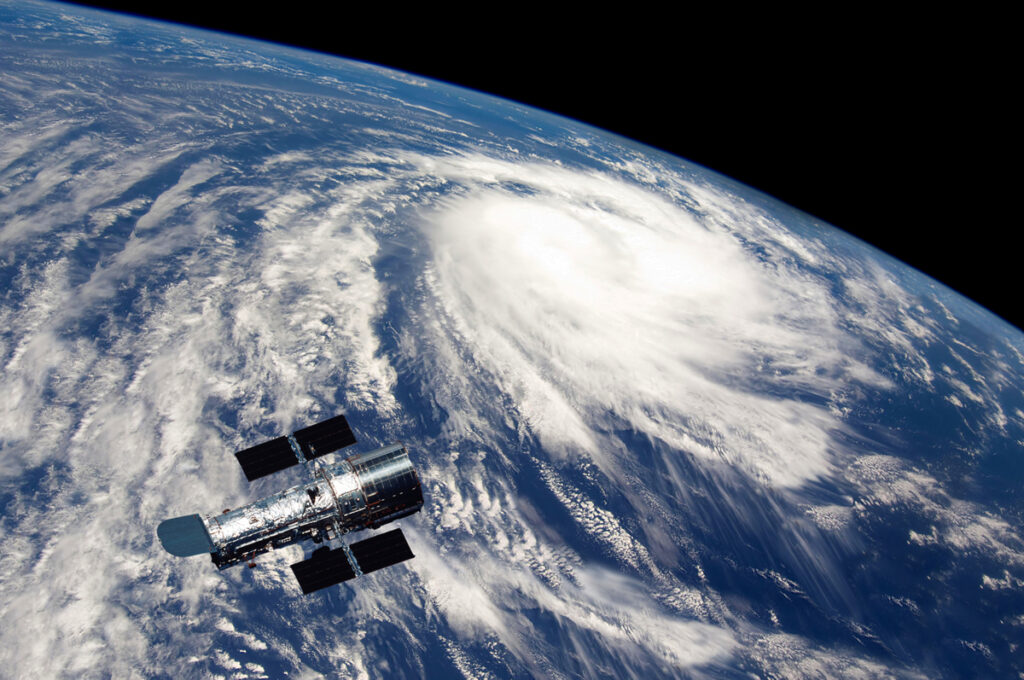

Investors are increasingly looking to understand the sustainability credentials of the businesses they invest in. To do so, they typically rely on companies’ self-disclosed annual reports, if these are available at all. This type of reporting is voluntary which means it is often incomplete, incomparable and outdated by the time it is published. Satellite data can provide a neutral, consistent and timely source of information to support investors with:

The Satellite Applications Catapult aims to activate this global, high growth market by:

The Spatial Finance Initiative has been established to bring together research capabilities in space, data science, and financial services to make them greater than the sum of their parts. The Initiative is designed to be a funnel, undertaking and coordinating world-leading academic research and channelling these into real-world finance-related applications. The Initiative has been established by the Alan Turing Institute, Green Finance Initiative, Satellite Applications Catapult, and the University of Oxford. It is a multi-disciplinary multi-stakeholder project.

Sustainable Finance is a broad market that covers all the players and structures of our financial system and links them up with a broad range of sustainability considerations.

Within this section, we have highlighted some relevant 3rd party reports that introduce a range of topics where high-quality data is extremely important and where there are various opportunities for satellite data to add value.